How to Prepare for Dollar Collapse in 2024

Do you ever wonder about how the uncontrolled printing of money, the inflation, the rise of cryptocurrencies, the growing US national debt, or even the confrontation coming from some of our strongest geopolitical adversaries could eventually lead to the collapse of the US Dollar? I do, and so do many leading financial experts.

For this reason, I decided to share with you how I’ve been preparing for such a scenario, with a very practical and accessible guide that aims to equip you with actionable strategies to safeguard your financial future.

Keep reading to uncover those strategies that will strengthen your finances in the event that the dollar collapses, and don’t forget to follow our blog for more expert survival tips and insights.

Understanding the Dollar Collapse Scenario

A dollar collapse refers to a situation where the US dollar, which currently holds the status of the world’s reserve currency, experiences a significant and rapid devaluation in terms of its purchasing power.

To put it simply, your dollars would buy significantly less, and the economic stability you’ve come to rely on could be shaken.

This isn’t exactly a fringe or conspiratorial dystopian prediction, it’s a real possibility that arises from the complex interaction of economic, geopolitical, and financial factors.

It’s important to emphasize that discussing a collapse of the dollar’s position is not intended to spread fear but to provide you with insights and strategies to ensure your financial stability in this hypothetical but increasingly realistic event.

Why Preparing for the Collapse of the US Dollar is Essential

The reasons to prepare are quite compelling, and I could essentially divide them into these 3 groups:

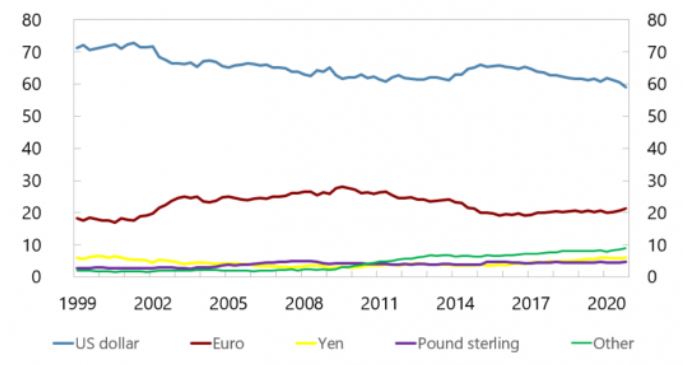

The Risk is Real: The fact that the dollar serves as the international reserve currency has been the bedrock of global finance for decades. However, this isn’t something inevitable, and the fact is that the Foreign Exchange Reserves of US Dollars have been continuously declining over this century, from 71% in 2000 to 59% in 2023. If we keep moving in the same direction, the collapse of the US Dollar is not only a plausible scenario but an actual certainty somewhere in the future.

Serious Individual Consequences: The implications of a dollar collapse extend far beyond global finance; they touch the lives of everyday individuals. Imagine a scenario where the dollar significantly loses its value – the purchasing power of your hard-earned money diminishes. The cost of essential goods and services skyrockets, and your overall financial stability is at risk.

Serious Collective Consequences: Additionally, you should bear in mind that a dollar collapse isn’t exactly an isolated event; it is a major circumstance with far-reaching consequences that can disrupt the entire economic ecosystem. Financial institutions would face unprecedented challenges, international transactions would become extremely complicated, and economic chaos could sweep across both developed and emerging markets.

This guide is your comprehensive resource, offering practical, straightforward advice for these complex scenarios. My goal is not to sow fear but to provide you with knowledge and strategies to protect your financial future.

In the following sections, I’ll explore actionable steps, alternative investments, and preparation techniques that can help you thrive in such an unstable economic landscape.

Steps to Prepare for a Dollar Collapse

Let’s explore some strategies, most of which I started using to upgrade the robustness of my financial position in case the dollar collapses:

Step 1: Diversify Your Investment Portfolio – Foreign Currency and others

Diversification is your first line of defense. Don’t put all your money/eggs in one basket because that will carry the greatest risk of value loss. To avoid that, you should consider investing in:

Precious Metals: Physical metals like gold and silver are generally considered a safe haven asset and can be wise additions to your portfolio. Investors typically turn to these metals as a way to protect their wealth in times of economic crisis, and this drives up gold prices. Buying physical gold can serve as a stable store of value and protect you against inflation and dollar devaluation.

Foreign Currency: Diversifying into stable foreign currencies of other developed markets, such as the Japanese yen or the Swiss franc, can provide a hedge against a falling dollar. You could look into the Chinese yuan as well, or even other developing countries, but that would be a riskier proposition. Talk to experienced currency traders or your financial advisor to discuss other currencies.

Real Estate Investments: a good example of fixed and tangible assets whose value likely doesn’t diminish with the falling value of the dollar. It can provide steady income through rent and potential capital appreciation, and it is a hedge against inflation and devaluation of the US dollar, with a potential for appreciation.

Foreign stocks and mutual funds in emerging economies: such investments in international equities can offer growth potential and higher returns and can act as a hedge against a weakening dollar. I personally favor looking into stocks in the emerging BRICS and global sector funds in renewable energy and healthcare.

Step 2: Enhance Your Financial Security

Building and maintaining wealth is critical to prepare for such a major event that would likely be viewed as an unexpected crisis for millions of people. Consider taking these additional steps:

Reduce Debt Obligations: Minimizing debt generally increases your financial resilience. And when you look at credit card debt, with its higher interest rates… it is a no-brainer.

Create a Robust Emergency Fund: A substantial fund can be a lifesaver in times of financial crisis or economic turmoil. Aim to save money to cover six to twelve months of living expenses in a separate and flexible savings account.

Develop additional Income Streams: In times of economic uncertainty, having multiple sources of income can greatly enhance financial security. My personal favorite is that you develop skills that allow for freelance or consulting work. Diverse income streams can provide financial cushioning if one source is affected by the economic downturn.

Step 3: Stay Informed and Adapt to Changes

Being well-informed and adaptable is crucial in the financial world.

- Monitor Economic Indicators: Keep an eye on inflation rates, interest rates, real estate prices, the stock market, and the national debt. These indicators can provide early warnings about the health of the national economy and, as a consequence, of the US dollar.

- Be Ready to Pivot: If you see increasing signs of a dollar crash, be prepared to adjust your strategies quickly, diversifying your portfolio and moving more money into tangible and safe-haven assets.

Advanced Strategies for Financial Preparedness

To further secure your financial future, consider these advanced strategies:

Explore Exchange Traded Funds (ETFs): ETFs can offer exposure to a diverse range of assets, including foreign currencies, international markets, and commodities, providing a broader hedge against a dollar collapse.

Consider Government and Corporate Bonds: Bonds can offer a relatively safe investment, though their effectiveness may vary depending on the economic climate and the issuing entity’s stability.

Digital Currencies: Cryptocurrencies like Bitcoin and Ethereum offer an alternative to traditional fiat currencies, can help diversify your portfolio, and can potentially hedge against the devaluation of the US dollar. But this market can be highly volatile, so approach it with caution.

Alternative Financial Prepping Strategies

If traditional financial moves aren’t appealing, or you’re looking for additional strategies, consider these alternatives:

Self-Reliant Skills and Sustainability: Embrace a more self-reliant lifestyle with sustainable practices. This includes growing your own food, reducing reliance on external resources, and minimizing expenses. Develop practical skills such as gardening, home repair, or basic survival skills. By integrating these efforts, you can create a self-sustaining lifestyle that enhances your resilience in chaotic times.

Collectible Assets: Explore investments in collectible items such as rare coins, stamps, art, or vintage items. These assets can hold or appreciate in value over time and can be an alternative means of wealth preservation in times of economic uncertainty.

Gold IRA: Another option gaining popularity is a Gold IRA, which allows you to hold physical gold or other precious metals in a tax-advantaged retirement account. This strategy can also act as a hedge against currency devaluation and economic instability, providing a level of financial security that traditional assets may not offer.

Navigating the Complexities of a Global Economy

In a world where economic trends are increasingly interconnected, understanding the dynamics of the global economy is crucial. You should pay special attention to:

The Role of Central Banks: Central banks, like the Federal Reserve, play a significant role in managing national economies and can influence the value of the US dollar and other fiat currencies.

International Trade and Relations: Changes in international agreements and diplomatic relations can impact the world economy and the dollar’s value.

Emerging Markets: Emerging economies can offer growth opportunities but come with higher risks. Understanding these markets is key to making informed investment decisions.

Preparing for High Inflation and Economic Downturns

Inflation and economic declines can be particularly challenging during a dollar collapse. Here’s how to prepare:

Invest in Assets That Typically Outperform During Inflation: Real estate and commodities, including precious metals, often do well during high inflation periods.

Focus on Debt Management: High inflation can increase the cost of borrowing, so managing existing debt and avoiding new high-interest debt is crucial.

Increase Liquidity: Having access to liquid assets can be a lifesaver during economic downturns, allowing you to cover expenses without incurring additional debt.

The Role of Foreign Currencies and the World’s Reserve Currency

Understanding the dynamics of foreign currencies and the concept of a reserve currency is essential in this context.

Diversify with Foreign, Stable Currencies: investing in currencies from countries with strong economic growth and lower debt levels can provide a good hedge against a dollar decline.

Understand the Impact of Reserve Currency Status: The US dollar’s status as the international reserve currency impacts its value. A loss of this status could lead to a decrease in demand for the dollar, impacting its value globally.

The Importance of Financial Planning and Seeking Professional Advice

Navigating the complexities of a potential dollar collapse requires careful financial planning and, often, professional advice. So you should ideally:

Develop a Comprehensive Financial Plan: This plan should consider your long-term financial goals, risk tolerance, and strategies for different economic scenarios.

Consult with a Financial Advisor: A professional can provide personalized advice based on your financial situation and goals, helping you make informed decisions.

Embracing Economic Uncertainty: A Mindset Shift

Adopting the right mindset is almost as important as practical financial steps.

Stay Positive and Proactive: Focus on what you can control, such as your savings rate, investment choices, and spending habits.

Embrace Lifelong Learning: The financial world is ever-evolving. Stay curious and informed about new financial trends, products, and strategies.

Build a Supportive Community: Engage with like-minded individuals who are also preparing for potential economic shifts. Sharing knowledge and experiences can be incredibly valuable.

Conclusion: Building Resilience in the Face of Economic Uncertainty

Preparing for a potential dollar collapse is about building resilience and flexibility in your financial life.

By diversifying your assets, reducing debt, building an emergency fund, staying informed, and being adaptable, you’re not just preparing for a Dollar collapse; you’re building a robust financial foundation that can withstand various economic challenges. And this is exactly why I’ve decided to move along these lines in the aftermath of the Covid-19 pandemic.

The truth is, with the right preparation and mindset, you can turn a situation of economic collapse into an opportunity for financial stability and growth.

Be safe and financially secure. Don’t forget to check out my other posts, and feel free to reach out to me.

FAQ – Frequently Asked Questions

What to do if the dollar collapses?

Diversify your investments, reduce debt, create an emergency fund, increase your revenue streams, and stay positive and adapt to change.

What would happen to gold if the dollar collapsed?

Most likely, they would skyrocket because investors would rush to that safe-haven asset.

Who would benefit in the US from a weak dollar?

US firms who export their goods and services to foreign markets, because their would become more competitive.

What currency would replace the US Dollar in case it collapsed?

Most experts point to currencies like the Euro, the Japanese Yen, or China’s Renminbi, but even a new world reserve currency could be created from scratch.